Charlotte risk management and insurance experts bring home national honors

Belk College of Business faculty have earned national honors for their research and teaching in risk management and insurance.

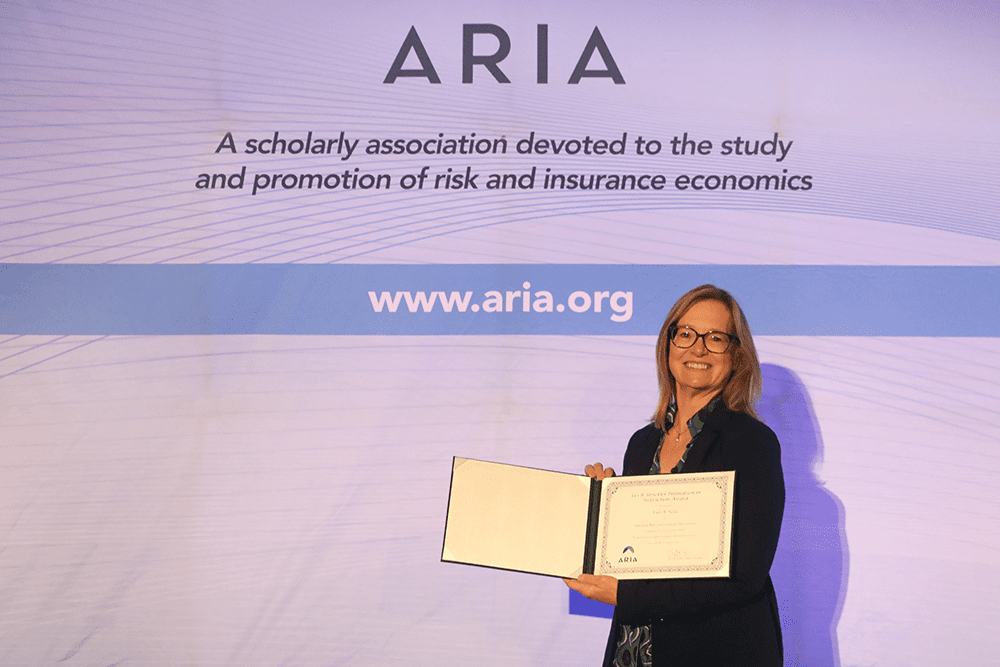

The American Risk and Insurance Association recognized Gene Lai and Faith R. Neale in August at the World Risk and Insurance Economics Congress, an international gathering of three leading organizations in risk and insurance.

Lai, James J. Harris Endowed Chair in Risk Management and Insurance, won the Risk Management and Insurance Review Award for Best Article. Associate Professor Neale earned the Les B. Strickler Innovation in Instruction Award.

“This well-deserved recognition of Dr. Lai and Dr. Neale illustrates the impact of the expertise they provide to our students and also to industry in the Charlotte region and worldwide who benefit from their work,” said Weidong Tian, chair of the Department of Finance. “Risk management and insurance are growing in importance not only as fields of study and research, but also in their impact on pretty much everyone’s lives.”

The academic paper award recognizes the best article published in the prior calendar year in the journal Risk Management and Insurance Review.

Lai’s paper, “CEO past distress experience and risk‐taking: Evidence from US property–liability insurance firms,” found that CEOs tend to make more cautious financial decisions for their current firms when they experienced financial difficulties with previous companies. This factor can shape the risk profile of a company, which is an important consideration for boards of directors, regulators, investors and others.

The teaching award celebrates an innovative idea used in risk management and insurance instruction.

Neale’s property catastrophe insurance simulation game teaches risk management and insurance operations in the competitive field of catastrophe-exposed property insurance.

Students participate in decision-making under uncertain conditions, considering factors such as catastrophe risk, insurance performance metrics and risk preferences while managing a virtual insurer’s capital and surplus. The game builds understanding of real-world underwriting challenges, negotiation and the impact of imperfect information. It bridges the gap between insurance theory and the practical complexities of managing catastrophe risk. It does this by challenging participants to maximize surplus through strategic risk management, underwriting, and reinsurance decisions in an environment of natural disaster risk.